boulder co sales tax 2020

This is the total of state county and city sales tax rates. CO Sales Tax Rate.

The 2020 Boulder County sales and use tax rate is 0985.

. March 2020 retail sales tax revenue was up 53 compared to March 2019 revenue including audit revenue and the additional recreational marijuana sales tax. The December 2020 total local sales tax rate was also 4985. Return the completed form in person 8-5 M-F or by mail.

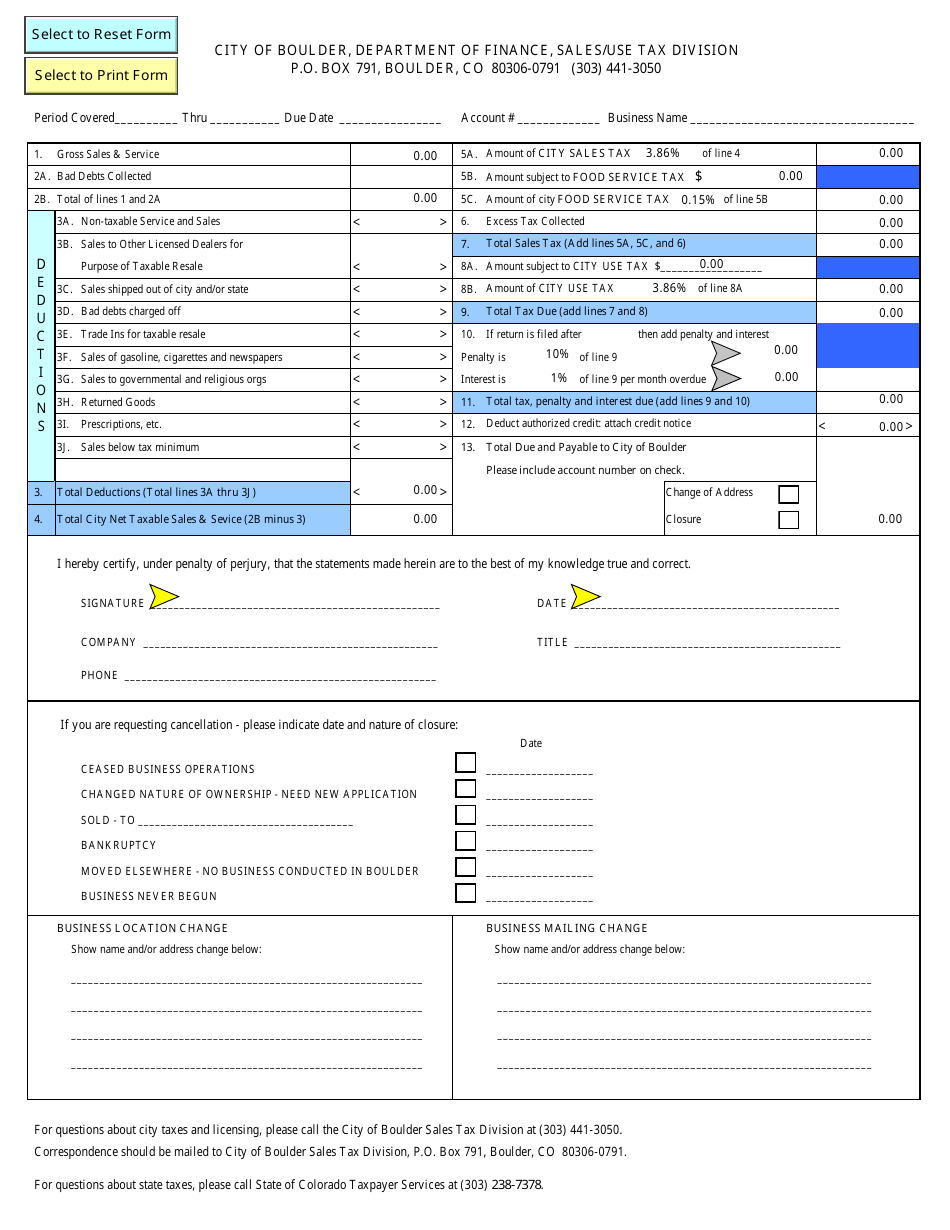

This is the total of state and county sales tax rates. The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and various tax auditing functions. The 2018 United States Supreme Court decision in South Dakota v.

There is no applicable city tax. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax. The minimum combined 2022 sales tax rate for Boulder Colorado is.

Without the large audit payment that was recorded in March 2020 sales tax revenue would have declined -23 Chart 3. December activity reflects severe public health restrictions after Boulder County moved to Level Red on November 20. Including audit revenue total sales and use tax increased from 2020 by 1657565 or 1829.

Boulder County CO Sales Tax Rate The current total local sales tax rate in Boulder County CO is 4985. Boulder County Niwot Lid. Has impacted many state nexus laws and sales tax collection requirements.

April 2020 retail sales tax revenue was down 246 compared to April 2019 revenue including audit revenue and the additional recreational marijuana sales tax. The Colorado sales tax rate is currently. The Boulder County sales tax rate is.

2055 lower than the maximum sales tax in co. The December 2020 total local sales tax rate was 8845. Salestaxbouldercoloradogov o llamarnos a 303-441-4425.

This increase results in a compound annual growth rate of 65 compared to 2019. CD 010 Applies to all sales that are Cultural Facilities District subject to RTD tax County of Boulder 0985 Sales Tax Use tax on Building Materials and Motor Vehicles Open Space 0475 0125 ending 123134 010 ending. YTD December 2020 sales tax including audit revenue declined by 9458832 or 833 when compared to YTD December 2019.

Sales tax is due on all retail transactions in addition to any applicable city and state taxes. You can print a 8845 sales tax table here. Para asistencia en español favor de mandarnos un email a.

The Boulder Sales Tax is collected by the merchant on all qualifying sales. Boulder County does not issue licenses for sales tax as the county sales tax is collected by the Colorado Department of Revenue CDOR. This is the total of state county and city sales tax rates.

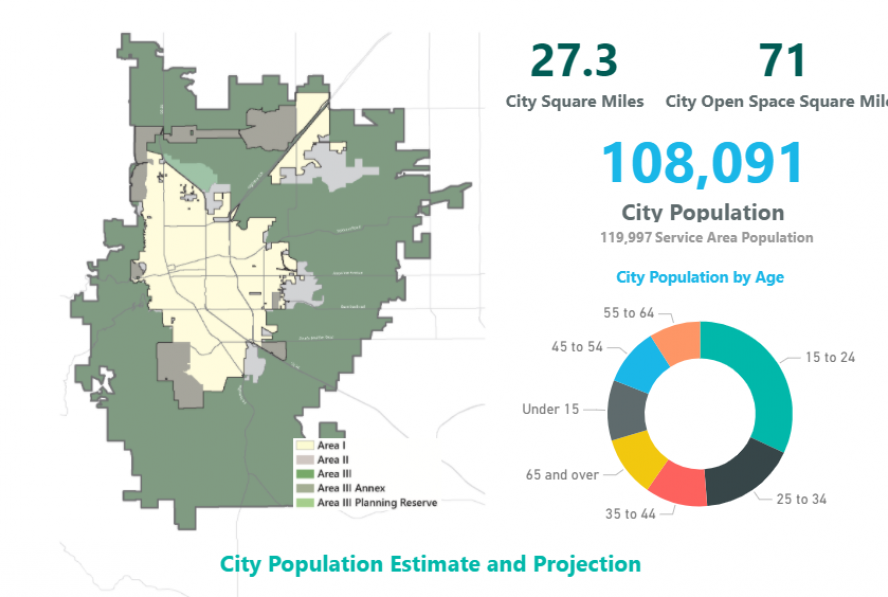

Boulder is a home rule city that is the county seat and most populous municipality of Boulder County Colorado United States. 2055 lower than the maximum sales tax in CO. The Boulder sales tax rate is.

The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. About City of Boulders Sales and Use Tax. For tax rates in other cities see Colorado sales taxes by city and county.

June 30 2020 at 1159 pm. Current City of Boulder use. How to Apply for a Sales and Use Tax License.

Month-Over-Month Change in Retail Taxable Sales. You can print a 9 sales tax table here. Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501.

The rate is comprised of individual voterapproved county sales and use tax ballot measures adopted to support county programs in conservaon transportaon offe nder management nonprofit capital. The County sales tax rate is. Boulders 40 Tax On Vaping Products Starts Wednesday.

Boulder in Colorado has a tax rate of 885 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Boulder totaling 595. The 80303 boulder colorado general sales tax rate is 8845. CBS4 Beginning Wednesday all vaping products sold in.

Month-Over-Month Change in Retail Taxable Sales. ICalculator US Excellent Free Online Calculators for Personal and Business use. Boulder Countys Sales Tax Rate is 0985 for 2020.

The Colorado state sales tax rate is currently. The current total local sales tax rate in Boulder CO is 4985. The 9 sales tax rate in Boulder Creek consists of 6 California state sales tax 025 Santa Cruz County sales tax and 275 Special tax.

The city population was 108250 at the 2020 United States Census making it the 12th most populous city in ColoradoBoulder is the principal city of the Boulder CO Metropolitan Statistical Area and an important part of the Front Range Urban. The sales tax jurisdiction name is Santa Cruz County Tourism Marketing District which may refer to a local government division. Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont.

The chart below illustrates the trend in sales tax revenue over the past four years. The city of boulder will no longer mail returns after jan. The minimum combined 2022 sales tax rate for Boulder County Colorado is.

Sales Tax YTD January 2022 sales tax including audit revenue and the additional 35 recreational marijuana tax increased by 1532800 or 190 when compared to YTD January 2021.

Boulder Cost Of Living Boulder Co Living Expenses Guide

Sales And Use Tax City Of Boulder

Taxes In Boulder The State Of Colorado

1 Thayer Rd Santa Cruz Ca 95060 5 Beds 5 Baths Santa Cruz Scotts Valley State Parks

Cience Debuts At 31 In The Financial Times Americas Fastest Growing Companies 2020 Send2press Newswire Financial Times How To Start Conversations Financial

Http Www Fullersothebysrealty Com Eng Sales Detail 218 L 868 Wpp6wg 1538 75th Street Boulder Co 80303 Luxury Swimming Pools Indoor Outdoor Pool Dream Pools

Moving To Boulder Boulder Co Relocation Homebuyer Guide

2515 Boulder Rd Altadena Ca 91001 Mls P1 4307 Redfin Bouldering House Styles Exterior

Boulder Colorado Co Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

733 Lakeshore Dr Boulder Co 80302 4 Beds 2 5 Baths House Inspiration Home Bouldering

Boulder Based Zayo Group Is A Private Company Again After Sale

1265 Chinook Way Boulder Co 80303 Realtor Com

Before After A Small Backyard Gets Seriously Elevated Colorado Homes Lifestyles Backyard Entertaining Space Small Backyard Backyard Upgrades

How Cu Boulder Is Funded Budget Fiscal Planning University Of Colorado Boulder

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

Innovation Technology City Of Boulder

Boulder Exploring New Taxes Fees As Revenues Falter Boulder Beat